Nigeria’s House of Representatives is stepping up efforts to restore public trust and promote transparency in the country’s financial sector, a move lawmakers say is vital for economic growth and long-term stability.

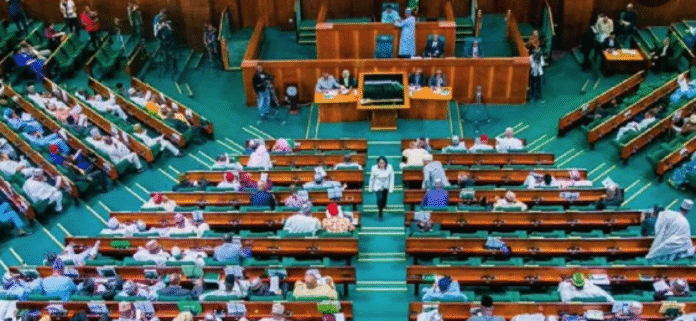

At a public hearing held on Thursday in Abuja, the House Committee on Banking Regulations presented two new bills designed to make business operations more transparent and protect citizens from financial fraud.

Two Bills, One Goal

The first bill seeks to regulate the purchase of renewables and establish a framework for the operation and control of business organisations.

The second, a proposed amendment to the Banks and Other Financial Institutions Act of 2020, focuses on protecting victims of fraudulent withdrawals and strengthening safeguards against cyber and financial crimes.

Committee Chairman Rep. Bello El-Rufai said both bills were part of a broader push to stabilise Nigeria’s financial ecosystem and create a more predictable environment for investors and consumers alike.

“Both bills share a common goal, enhancing transparency and trust to stabilise Nigeria’s financial system,” El-Rufai said. “Nigeria has the potential to ensure that businesses thrive in every part of the country.”

Calls for Reform and Inclusion

Governor Uba Sani of Kaduna State lauded the initiative, describing it as a significant step toward reforming Nigeria’s financial framework. Represented by Mr. Fabian Okoye, Sani said the legislation would open up more funding opportunities for businesses, particularly in the renewable energy sector, and boost Nigeria’s export competitiveness.

“These reforms will empower businesses, improve access to capital, and enhance transparency,” he said. “It’s a positive move for both economic stability and investor confidence.”

Concerns Over Slow Judicial Processes

However, representatives from the private sector warned that the effectiveness of the proposed reforms could be undermined by delays in Nigeria’s judicial system.

Mr. Chukwuemeka Eze, speaking on behalf of the organised private sector, said that financial disputes often take years to resolve in court, a challenge that continues to discourage investment.

“People can spend eight to ten years seeking settlements,” Eze noted. “Without judicial efficiency, even the best financial reforms may struggle to deliver their intended impact.”

Building Trust in the System

Analysts say the proposed legislation signals a renewed focus on rebuilding confidence in Nigeria’s financial sector, which has faced challenges ranging from fraud to weak regulatory oversight.

If passed, the bills could provide stronger legal backing for financial transparency and consumer protection, while positioning Nigeria as a more reliable destination for both local and international investment.

As the hearings continue, all eyes will be on how lawmakers balance reform with enforcement, and whether these efforts can translate into the stable, transparent financial system many Nigerians have long called for.